What we’re really building at Uxopian: Inside the transformation

Uxopian is evolving: discover how our unified suite is transforming enterprise information management through innovation, integration, and next-gen...

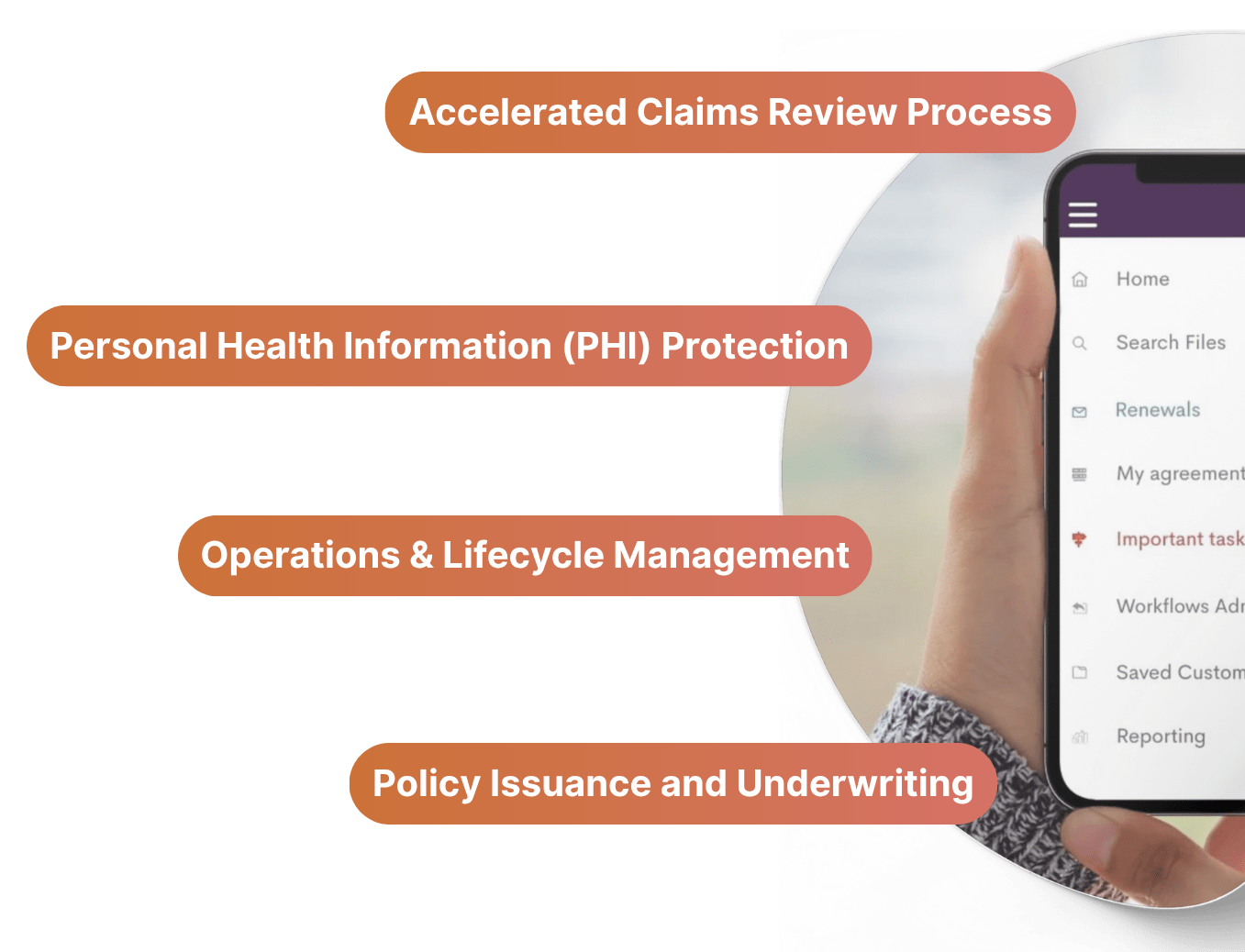

For insurers, content drives every decision, from policy creation to claims resolution. Yet, outdated systems and ever-evolving compliance demands often impede progress. Uxopian empowers insurance organizations to overcome these hurdles, achieving unprecedented control and operational agility

-min-1.png)

Unlock historical insurance data. Fast2 ensures seamless, large-scale migration of legacy policies, claims, and client records from outdated systems, guaranteeing data integrity and continuous front-office access

Providing instant access for advisors and staff to view and annotate critical policy applications, identity documents, or complex claims directly within workflows

Forge a unified content backbone across all insurance lines of business. FlowerDocs consolidates documentation from underwriting, claims, policy administration, and customer service into a single, adaptable repository, streamlining operations, enhancing internal controls, and simplifying regulatory reporting without redundant data

Integrate robust regulatory compliance into every insurance workflow. Uxopian enforces automated retention rules, precise access rights, and immutable audit trails at every stage. This ensures adherence to regulations like Solvency II and state privacy laws, alongside internal audit policies. Achieve compliance by design, effortlessly

FlowerDocs search & indexing engine

The FlowerDocs NoSQL core seamlessly integrates with your backend for unparalleled indexing and search. Effortlessly locate any unstructured insurance content, from scanned applications, claims forms, multimedia, and communications, enabling immediate retrieval.

Fast2 for seamless data ingestion and normalization

Fast2 streamlines the capture and preparation of insurance data from diverse origins. It intelligently automates high-volume intake, normalizing metadata and structuring disparate content like email, legacy exports, and digital documents. Every piece is tagged and instantly ready for processing

ARender for universal document format handling

ARender guarantees instant, unobstructed access to every insurance document, irrespective of its native format. It masterfully handles complex files such as large PDFs, and various image types, eliminating cumbersome downloads or specialized viewing software, thus accelerating critical reviews for underwriters and adjusters

Intelligent data governance

Maintain control over vast datasets with granular access permissions. Define and enforce rules for data visibility and usage based on content type, policy status, or claim sensitivity, ensuring compliance without increasing manual overhead

ARender for automated sensitive data protection

ARender proactively safeguards sensitive PII and PHI embedded within your documents, initiating protection before content even reaches user interfaces. It executes high-volume, automated redactions, data masking, or file-level encryption at the point of origin, ensuring strict compliance with privacy regulations such as HIPAA and GDPR

FlowerDocs for robust content governance and retention

FlowerDocs builds precise compliance rules directly into your entire content lifecycle. It automatically enforces retention schedules, legal holds, and stringent version controls, ensuring that every policy, claim, and customer interaction consistently meets regulatory mandates and is fully auditable.

Fast2 for compliant data ingestion

Fast2 guarantees that all incoming insurance content adheres to rigorous compliance standards right from its point of entry. It can automatically apply initial classification, tagging, and even pre-redaction protocols as documents integrate into your system, establishing a framework for entirely compliant workflows.

Granular access governance

Control who sees what, based on roles, regulations, and content sensitivity. Manage access permissions at a highly granular level across your entire content repository, ensuring that only authorized personnel can view or interact with sensitive insurance data

Fast2 for secure, high-volume data migration

Fast2 establishes a robust, secure pipeline for transitioning millions of historical policies, claims, and customer records from any legacy ECM to your modern platform or cloud. It meticulously preserves data integrity and audit lineage throughout high-volume transfers

FlowerDocs as your adaptable content repository

Post-migration, FlowerDocs serves as your adaptive, scalable content repository, creating a future-proof foundation. It consolidates disparate information from legacy environments into a unified, intelligently structured system that accommodates evolving data models

ARender for validated document integrity

ARender validates document accuracy and integrity post-migration, ensuring uninterrupted usability. It facilitates instant viewing of all transferred files in their original format, enabling rapid verification and confirming annotations and redactions remain intact and fully accessible

Traceable migration governance

Maintain complete oversight and auditability throughout the migration process. Define and enforce precise access and transformation rules for migrated content, ensuring compliance with retention policies and regulatory mandates without disruption

FlowerDocs for group level 360°view

Group-level visibility with entity-level precision. FlowerDocs organizes each customer’s documentation into a centralized view, while maintaining local-specific rules. This enables shared service centers to handle onboarding or compliance tasks without duplicating files or losing control

Fast2 for synchronized content operations

Fast2 ensures all client documentation remains perfectly synchronized across core systems, regional branches, and group archives. It expertly manages format harmonization, incremental updates, and secure transfers between entities, providing fully traceable content flows at all times

ARender for consistent document review

ARender enables seamless cross-jurisdictional collaboration on shared files, eliminating format incompatibilities and compliance worries. Each reviewer accesses precisely the version they are authorized to see, supported by audit-proof annotation and redaction capabilities, ensuring consistent insights globally

Claims management and resolution

Keep every claim process structured, traceable, and in sync, from first notification of loss to final settlement

First notice of loss capture

The claims process transforms initial chaos into an organized digital file. Upon receiving a new claim, FNOL reports, supporting evidence, and claimant documents are swiftly uploaded or scanned. FlowerDocs immediately captures, tags, and structures all information into a dedicated folder linked to the claimant and policy. This includes instant content capture, indexing, and automated routing

Expedited claim evaluation

Claims adjusters pivot from document management to focused decision making. They instantly review initial reports, repair estimates, medical records, and legal briefs directly within their workflow. ARender ensures all documents are viewable, annotatable, and version-controlled, regardless of format:

Claim approval and payout

The approval and settlement phase ensures every agreement is finalized with confidence. Following approval, settlement offers and release forms are generated and securely signed. FlowerDocs immutably locks the signed version, logging the event and associating updates or annexes with clear version history. The claim is then immediately ready for payout or closure, supported by centralized storage and structured lineage

Ongoing claim documentation and updates

Maintain precise control over evolving claims with real-time content updates. Additional proofs, subrogation records, communication logs, and external legal correspondence integrate flawlessly, free from duplication or formatting discrepancies. Fast2 automates daily processing of scanned mail, uploads, and emails, ensuring all incoming content routes to the correct claim file and synchronizes with servicing teams

Final claim file retirement and audit

Claims are closed cleanly and archived with confidence. Once a claim is settled, repudiated, or litigated, FlowerDocs automatically applies predefined retention rules. Fast2 facilitates migration of historical claim content from older systems into a consistent structure, ensuring it is instantly ready for regulatory audits and compliance reviews. This includes automated lifecycle management, robust retention enforcement, and meticulous metadata cleanup

Archived claims data conversion

Address the challenge of managing years of historical records. Fast2 efficiently migrates legacy claim files into your current structured environment. It harmonizes metadata, aligns various document formats, and transforms dormant archives into readily usable, living resources for ongoing operations and compliance

Policy servicing and lifecycle management

Maintain long-term client relationships and ensure seamless policy adjustments throughout the entire policy lifecycle

Policyholder support and document retrieval

When a customer reaches out for an update or modification, customer service gains instant, secure access to a comprehensive 360-degree policy view through FlowerDocs. This includes all previous communications, endorsements, and billing history, meticulously organized, eliminating waiting time or misplacement

Policy adjustments and renewal management

Precision is paramount when processing policy endorsements, renewals, or premium adjustments. ARender enables immediate viewing and annotation of all related policy changes, guaranteeing every party reviews the accurate version

Premium and billing document handling

Efficiently manage payment proofs, billing statements, and financial adjustments. Fast2 ensures all incoming financial documents, whether physical scans or digital files, are precisely tagged, routed, and seamlessly integrated into the correct policy record in real time. This allows the policy file to expand while remaining perfectly organized and instantly searchable

Policyholder communication tracking

Every customer interaction, whether an email, physical mail, or internal note related to a policy, is automatically captured, indexed, and meticulously stored within the policy file. This robust process establishes a complete audit trail and ensures seamless service continuity, making every customer touchpoint traceable

Policy record retention and auditability

Throughout a policy's lifecycle and upon its conclusion, preserving its complete history is vital. FlowerDocs automatically enforces predefined lifecycle rules and retention policies. All historical policy data, including superseded versions and associated correspondence, is securely archived and remains entirely auditable for regulatory compliance and future reference

From initial application to policy activation, ensure your new business processes are precise, rapid, and compliant.

Application submission & data capture

A new application arrives with identity proofs, financials, medical histories, and property assessments. FlowerDocs immediately captures, stores, and organizes this intake into a structured digital folder linked to the applicant and policy. This ensures instant capture, indexing, and automated folder assignment, eliminating delays and lost information

Risk assessment & review

Underwriters demand clarity for risk assessments. ARender provides immediate access to view and annotate all supporting documents, eliminating tedious downloads and format issues. Comments and approvals link to the document version, ensuring meticulous tracking and auditability for every review

Policy generation & bind

Following risk assessment and agreed terms, rapid policy generation is essential. Documents are swiftly produced, validated, and secured with e-signatures. FlowerDocs immutably locks the signed version, recording the binding event. Subsequent updates or annexes are systematically stored, maintaining clear lineage. The policy is instantly finalized for issuance

Continuous data ingestion

Managing evolving policy information involves continuous data flow. As new supporting data or compliance documents emerge for proposed or active policies, they are ingested in real time and precisely indexed. Fast2 expertly manages batch injections of external data, ensuring all content is clean, structured, and instantly searchable as the policy file expands

Archiving and compliance for new policies

Upon policy binding or issuance, complete documentation is paramount. Every action is meticulously recorded, compliance disclosures are properly filed, and predefined retention rules are automatically applied. This ensures no operational step is ever left undocumented or unverifiable, guaranteeing full audit readiness for every new piece of business

Uxopian is evolving: discover how our unified suite is transforming enterprise information management through innovation, integration, and next-gen...

Join Uxopian Academy for free self-paced courses on Flowerdocs, eProcess, ARender and Fast2. Start with our Fast2 practitioner course to grow your...

Explore how blockchain is transforming content management, from legal recognition to real-world use cases in compliance, healthcare, supply chain,...

Discover DocLink in ARender: create seamless hyperlinks between documents for faster navigation, better context, and zero workflow interruption.

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.